Nzd To Aud

The New Zealand Dollar continues to drag its toes over the popular Australian Dollar to 0.9200 (1.0870) Wednesday. The RBA’s Lowe confirmed present coverage yesterday and vowed to upscale its bond purchases to do whatever the economy needs to remain useful. Australian Current Account published at eight.4B surplus, a lot higher than the 6.3B expected primarily based on the shortcoming to commerce internationally due to coronavirus causes, this gave the information pushed the AUD greater.

We observe stay charges of over 60 currencies to ensure you’re the primary to know. For instance, you possibly can instantly convert 18 NZD to AUD primarily based on the rate provided by “Open Exchange Rates” to resolve whether or not you higher proceed to change or postpone foreign money conversion until higher instances. The page supplies data about today’s worth of eighteen dollars in Australian Dollars. The interactive form of the forex calculator ensures navigation in the precise quotations of world currencies based on “Open Exchange Rates” and displays the data in a graph. The Australian greenback is the forex of the Commonwealth of Australia, that together with Cocos Islands, Christmas Island, and Norfolk Island, in addition to the unbiased Pacific Island states of Kiribati, Nauru and Tuvalu.

Why Currencyfair?

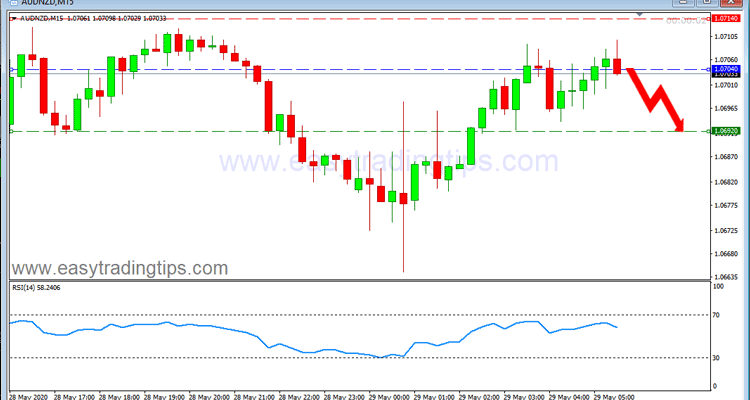

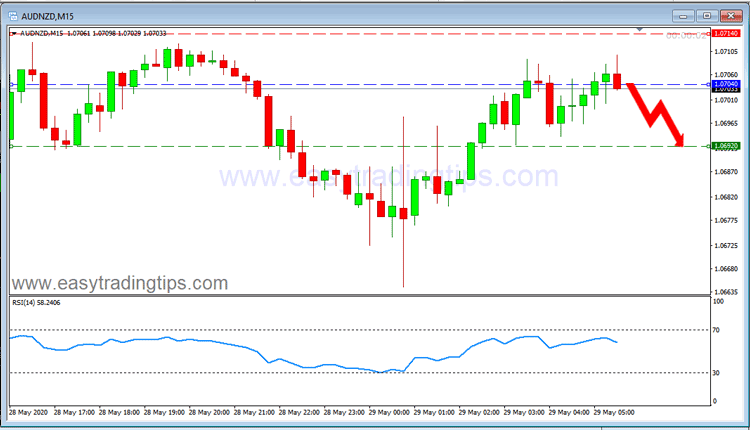

Lowe spoke Thursday reinforcing comments of a price reduce as early as 3rd November to zero.10% and RBNZ’s Hawkesbury additionally, all however confirmed adverse charges are a given probably later this year or early 2021. Price on the chart has bounced off pivotal resistance circa zero.9330 (1.0715) the high from late July. Our view on a return to 0.9400 (1.0638) pre weekly close was bang on with value bouncing off this level back to zero.9380 in the New Zealand Dollar , Australian Dollar pair. We saw one other attempt by the kiwi to push into new territory Monday again however 0.9400 (1.0638) was rejected to the 0.9375 (1.0665) region.

- The RBA’s Lowe confirmed present coverage yesterday and vowed to upscale its bond purchases to do regardless of the financial system needs to stay practical.

- The Australian dollar outperformed the New Zealand dollar within the first half of this week, driving the pair to a low of zero.9300 (1.0753) on Wednesday.

- The New Zealand greenback is the currency of New Zealand which circulates within the Cook Islands, Niue, Tokelau, and the Pitcairn Islands.

- There is significant resistance around 0.9600 and that will properly proceed to cap the pair.

- A giant number of individuals returned to the workforce- 178,000 with unemployment ticking up slightly to 7.zero% from 7.1% forecast.

The Aussie remains basically bearish as its closely exposed to US trade tensions with China. Price Friday tracks across the zero.9340 (1.0700) space with Aussie Retail Sales now the focus later today for the pair. A mild economic calendar next week with only Aussie enterprise and consumer confidence to hold attention.

Popular Nzd Pairing

The volatility seen final week on the NZD/AUD cross looks to have abated with this cross settling across the 0.9400 (1.0638) mark. Aussie RBA minutes revealed later today are not expected to convey any surprises after the RBA saved rates on maintain earlier in the month. We expect much of this week’s attention to remain on the USD so any this cross should remain comparatively stable over the next few days.

Also of observe is the wage subsidy which ends on the finish of the month which could sign job losses over the following few months is an actual chance. The Aussie will discover it onerous to interrupt through sturdy support at 0.9250 (1.0810) however might come close taking a look at present trend and momentum. The New Zealand Dollar broke under pivotal support at 0.9250 (1.0815) this morning in opposition to the Australian Dollar on its way to reach zero.9205 (1.0865). This stage was final seen in October 2020 with the AUD recovering from an even bigger move around zero.9590 (1.0430) high again in November.